The role of emotional design in financial apps

The role of emotional design in financial apps

7 Jun 2024

7 Jun 2024

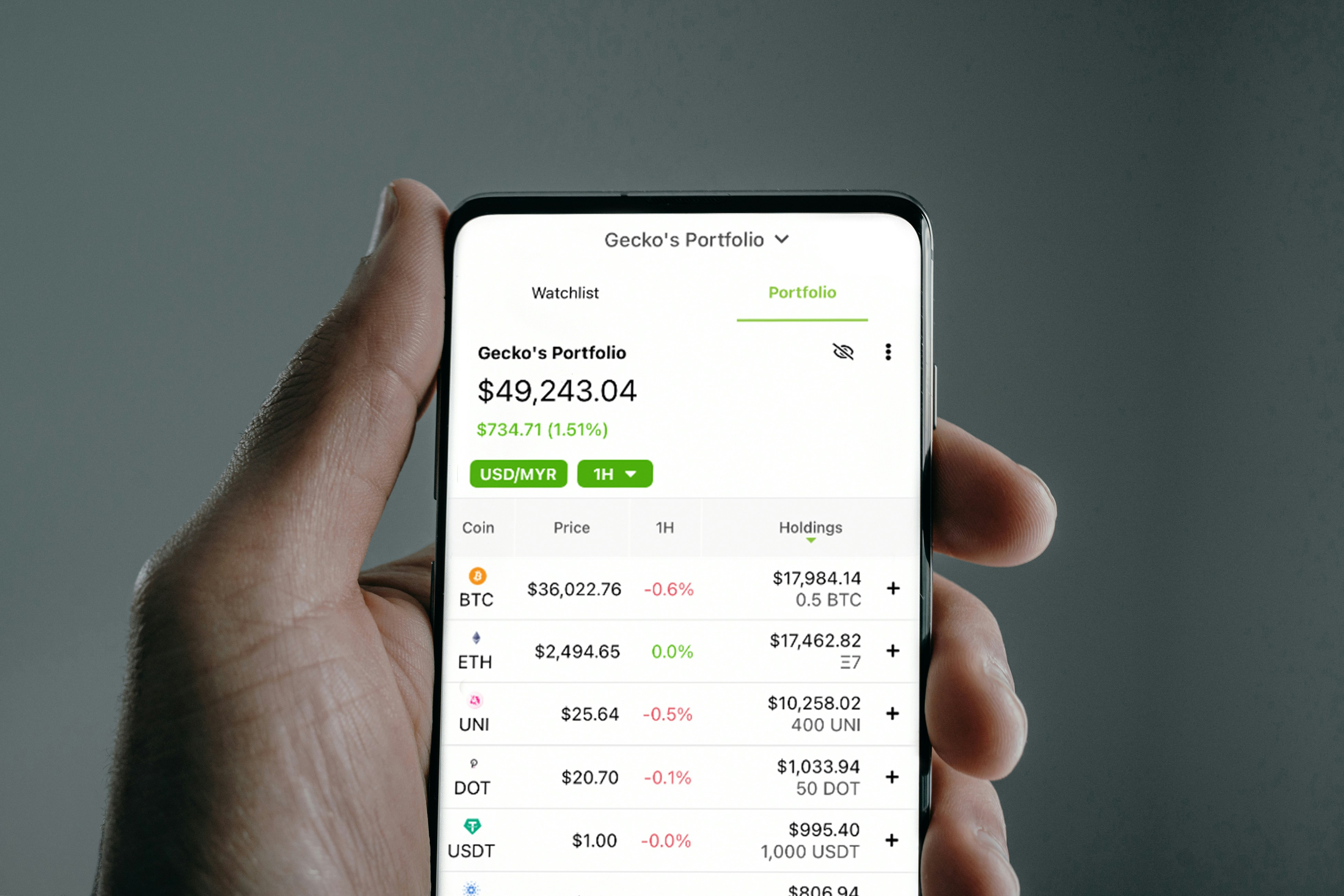

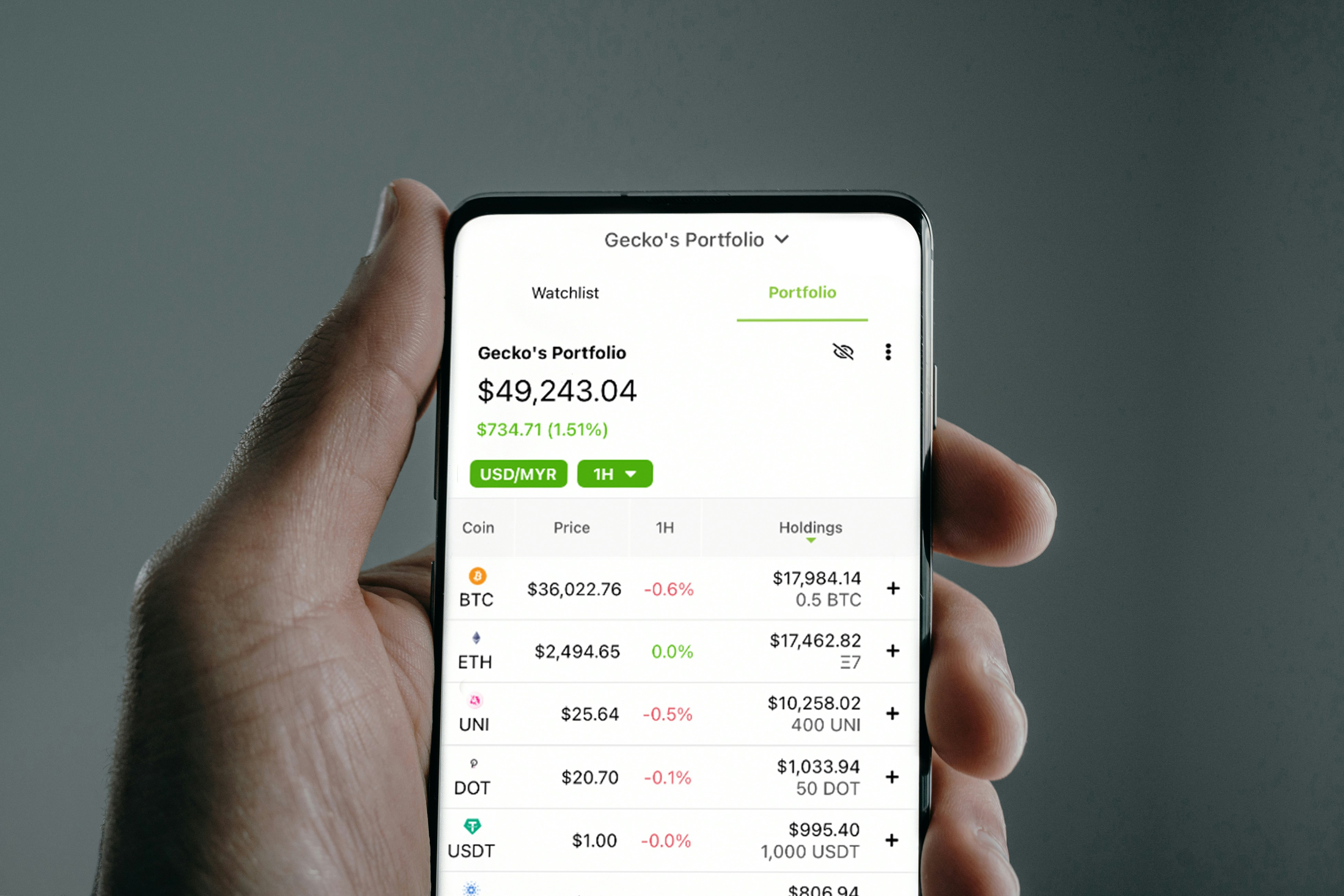

Photo by PiggyBank on Unsplash

Financial apps are integral to modern life, helping users manage their money, make investments, and plan for the future. Given the sensitivity of financial information and the inherent anxiety many users feel about money, emotional design plays a crucial role in these applications. By focusing on emotional design, financial apps can build trust, reduce user anxiety, and create a more engaging and supportive user experience. Here's how to incorporate emotional design effectively in financial apps:

Building Trust through Design

Consistent Branding

Use consistent colors, fonts, and imagery that align with your brand's identity. Consistent branding reinforces trust and reliability.

Professional Aesthetics

Employ clean, professional, and modern design elements to convey credibility and stability.

Clear Information

Present financial data and terms in a clear, understandable manner. Avoid jargon and use plain language to make information accessible.

Transparent Processes

Clearly explain the steps involved in transactions and financial processes, reducing uncertainty and fostering trust.

Reducing User Anxiety

Minimalistic Design

Use a minimalistic design approach to avoid overwhelming users with too much information at once. Focus on essential features and information.

Progressive Disclosure

Gradually reveal information as needed, helping users focus on one task at a time without feeling overloaded.

Positive Reinforcement

Use positive visual cues, such as green checkmarks or success messages, to reassure users when they complete actions correctly.

Immediate Feedback

Provide immediate and clear feedback on user actions, such as confirmation messages for successful transactions or error messages with clear guidance.

Enhancing User Engagement

Tailored Experience

Personalize the user experience based on individual user data, such as spending habits, financial goals, and preferences. This can include customized dashboards, personalized tips, and relevant product suggestions.

Goal Tracking

Allow users to set financial goals and track their progress. Visual representations of their progress can be highly motivating and emotionally rewarding.

Human-like Interactions

Incorporate elements that mimic human interactions, such as friendly, conversational language, and chatbots that offer empathetic responses.

Supportive Messaging

Use encouraging and empathetic language to support users, especially when dealing with sensitive financial situations.

Creating a Positive Emotional Experience

Welcoming Colors

Use warm, welcoming colors that evoke positive emotions and a sense of security. Avoid overly bright or harsh colors that can increase anxiety.

Friendly Illustrations

Use illustrations and icons that are friendly and relatable, making the app feel more approachable and less intimidating.

Interactive Elements

Introduce gamification elements, such as challenges, badges, or rewards for reaching financial milestones. This can make managing finances feel more engaging and less daunting.

Progress Indicators

Use progress bars and achievement badges to visually represent users’ progress toward their financial goals.

Providing Educational Resources

Tutorials and Guides

Include tutorials, guides, and FAQs to help users understand how to use the app and manage their finances effectively.

Educational Content

Provide articles, videos, and interactive tools that educate users about financial literacy, helping them make informed decisions.

Just-In-Time Information

Offer contextual help and tips at the moment users need them, such as explaining financial terms during transactions or offering budgeting tips when users set spending limits.

Interactive Assistance

Incorporate chatbots or virtual assistants that can provide real-time assistance and answer users’ questions on the spot.

Ensuring Security and Privacy

Security Icons

Use recognizable security icons and messages to reassure users that their data is protected.

Clear Privacy Policies

Clearly communicate privacy policies and how user data is used, building trust through transparency.

Privacy Settings

Give users control over their privacy settings and allow them to easily manage permissions and data sharing preferences.

Two-Factor Authentication

Offer two-factor authentication and other security features to enhance protection and give users peace of mind.

Incorporating emotional design into financial apps is essential for creating a user experience that builds trust, reduces anxiety, and fosters long-term engagement. By focusing on elements that address users' emotional needs, financial apps can become not only functional tools but also supportive partners in users' financial journeys. Through thoughtful design that prioritizes clarity, empathy, and security, financial apps can significantly enhance user satisfaction and loyalty.

Financial apps are integral to modern life, helping users manage their money, make investments, and plan for the future. Given the sensitivity of financial information and the inherent anxiety many users feel about money, emotional design plays a crucial role in these applications. By focusing on emotional design, financial apps can build trust, reduce user anxiety, and create a more engaging and supportive user experience. Here's how to incorporate emotional design effectively in financial apps:

Building Trust through Design

Consistent Branding

Use consistent colors, fonts, and imagery that align with your brand's identity. Consistent branding reinforces trust and reliability.

Professional Aesthetics

Employ clean, professional, and modern design elements to convey credibility and stability.

Clear Information

Present financial data and terms in a clear, understandable manner. Avoid jargon and use plain language to make information accessible.

Transparent Processes

Clearly explain the steps involved in transactions and financial processes, reducing uncertainty and fostering trust.

Reducing User Anxiety

Minimalistic Design

Use a minimalistic design approach to avoid overwhelming users with too much information at once. Focus on essential features and information.

Progressive Disclosure

Gradually reveal information as needed, helping users focus on one task at a time without feeling overloaded.

Positive Reinforcement

Use positive visual cues, such as green checkmarks or success messages, to reassure users when they complete actions correctly.

Immediate Feedback

Provide immediate and clear feedback on user actions, such as confirmation messages for successful transactions or error messages with clear guidance.

Enhancing User Engagement

Tailored Experience

Personalize the user experience based on individual user data, such as spending habits, financial goals, and preferences. This can include customized dashboards, personalized tips, and relevant product suggestions.

Goal Tracking

Allow users to set financial goals and track their progress. Visual representations of their progress can be highly motivating and emotionally rewarding.

Human-like Interactions

Incorporate elements that mimic human interactions, such as friendly, conversational language, and chatbots that offer empathetic responses.

Supportive Messaging

Use encouraging and empathetic language to support users, especially when dealing with sensitive financial situations.

Creating a Positive Emotional Experience

Welcoming Colors

Use warm, welcoming colors that evoke positive emotions and a sense of security. Avoid overly bright or harsh colors that can increase anxiety.

Friendly Illustrations

Use illustrations and icons that are friendly and relatable, making the app feel more approachable and less intimidating.

Interactive Elements

Introduce gamification elements, such as challenges, badges, or rewards for reaching financial milestones. This can make managing finances feel more engaging and less daunting.

Progress Indicators

Use progress bars and achievement badges to visually represent users’ progress toward their financial goals.

Providing Educational Resources

Tutorials and Guides

Include tutorials, guides, and FAQs to help users understand how to use the app and manage their finances effectively.

Educational Content

Provide articles, videos, and interactive tools that educate users about financial literacy, helping them make informed decisions.

Just-In-Time Information

Offer contextual help and tips at the moment users need them, such as explaining financial terms during transactions or offering budgeting tips when users set spending limits.

Interactive Assistance

Incorporate chatbots or virtual assistants that can provide real-time assistance and answer users’ questions on the spot.

Ensuring Security and Privacy

Security Icons

Use recognizable security icons and messages to reassure users that their data is protected.

Clear Privacy Policies

Clearly communicate privacy policies and how user data is used, building trust through transparency.

Privacy Settings

Give users control over their privacy settings and allow them to easily manage permissions and data sharing preferences.

Two-Factor Authentication

Offer two-factor authentication and other security features to enhance protection and give users peace of mind.

Incorporating emotional design into financial apps is essential for creating a user experience that builds trust, reduces anxiety, and fosters long-term engagement. By focusing on elements that address users' emotional needs, financial apps can become not only functional tools but also supportive partners in users' financial journeys. Through thoughtful design that prioritizes clarity, empathy, and security, financial apps can significantly enhance user satisfaction and loyalty.

Financial apps are integral to modern life, helping users manage their money, make investments, and plan for the future. Given the sensitivity of financial information and the inherent anxiety many users feel about money, emotional design plays a crucial role in these applications. By focusing on emotional design, financial apps can build trust, reduce user anxiety, and create a more engaging and supportive user experience. Here's how to incorporate emotional design effectively in financial apps:

Building Trust through Design

Consistent Branding

Use consistent colors, fonts, and imagery that align with your brand's identity. Consistent branding reinforces trust and reliability.

Professional Aesthetics

Employ clean, professional, and modern design elements to convey credibility and stability.

Clear Information

Present financial data and terms in a clear, understandable manner. Avoid jargon and use plain language to make information accessible.

Transparent Processes

Clearly explain the steps involved in transactions and financial processes, reducing uncertainty and fostering trust.

Reducing User Anxiety

Minimalistic Design

Use a minimalistic design approach to avoid overwhelming users with too much information at once. Focus on essential features and information.

Progressive Disclosure

Gradually reveal information as needed, helping users focus on one task at a time without feeling overloaded.

Positive Reinforcement

Use positive visual cues, such as green checkmarks or success messages, to reassure users when they complete actions correctly.

Immediate Feedback

Provide immediate and clear feedback on user actions, such as confirmation messages for successful transactions or error messages with clear guidance.

Enhancing User Engagement

Tailored Experience

Personalize the user experience based on individual user data, such as spending habits, financial goals, and preferences. This can include customized dashboards, personalized tips, and relevant product suggestions.

Goal Tracking

Allow users to set financial goals and track their progress. Visual representations of their progress can be highly motivating and emotionally rewarding.

Human-like Interactions

Incorporate elements that mimic human interactions, such as friendly, conversational language, and chatbots that offer empathetic responses.

Supportive Messaging

Use encouraging and empathetic language to support users, especially when dealing with sensitive financial situations.

Creating a Positive Emotional Experience

Welcoming Colors

Use warm, welcoming colors that evoke positive emotions and a sense of security. Avoid overly bright or harsh colors that can increase anxiety.

Friendly Illustrations

Use illustrations and icons that are friendly and relatable, making the app feel more approachable and less intimidating.

Interactive Elements

Introduce gamification elements, such as challenges, badges, or rewards for reaching financial milestones. This can make managing finances feel more engaging and less daunting.

Progress Indicators

Use progress bars and achievement badges to visually represent users’ progress toward their financial goals.

Providing Educational Resources

Tutorials and Guides

Include tutorials, guides, and FAQs to help users understand how to use the app and manage their finances effectively.

Educational Content

Provide articles, videos, and interactive tools that educate users about financial literacy, helping them make informed decisions.

Just-In-Time Information

Offer contextual help and tips at the moment users need them, such as explaining financial terms during transactions or offering budgeting tips when users set spending limits.

Interactive Assistance

Incorporate chatbots or virtual assistants that can provide real-time assistance and answer users’ questions on the spot.

Ensuring Security and Privacy

Security Icons

Use recognizable security icons and messages to reassure users that their data is protected.

Clear Privacy Policies

Clearly communicate privacy policies and how user data is used, building trust through transparency.

Privacy Settings

Give users control over their privacy settings and allow them to easily manage permissions and data sharing preferences.

Two-Factor Authentication

Offer two-factor authentication and other security features to enhance protection and give users peace of mind.

Incorporating emotional design into financial apps is essential for creating a user experience that builds trust, reduces anxiety, and fosters long-term engagement. By focusing on elements that address users' emotional needs, financial apps can become not only functional tools but also supportive partners in users' financial journeys. Through thoughtful design that prioritizes clarity, empathy, and security, financial apps can significantly enhance user satisfaction and loyalty.

Siap untuk memimpin masa depan?

©2024, rajeshsiburian

Siap untuk memimpin masa depan?

©2024, rajeshsiburian

Siap untuk memimpin masa depan?

©2024, rajeshsiburian